Crowdfunding campaigns are a form of fundraising where the organizer sets the goal and can either help specific people or a larger group or cause. They can also have a business purpose, raising money for a new invention or business project. Campaign organizers often ask for donations through social media posts or on crowdfunding sites. Each platform has its own rules, including how to set up the campaign, how much fees are kept, and when the money is disbursed. The money raised goes to the campaign organizer, who is expected to tell the truth about the purpose and how it will be used.1 Scammers and dishonest businesspeople can set up crowdfunding campaigns to raise money for themselves. Only donations to a charity are tax deductible, and if it's important to verify that the organization is registered with the RBI as a charity, they can be found in the RBI's Tax-Exempt Organizations or ROC’s Section 8 organizations search tool.

In 2021, The Financial Action Task Force (FATF), a global monitor on money laundering and terrorist financing, acknowledged crowdfunding as a legitimate means of fundraising, noting its predominantly lawful nature. This method supports diverse causes such as disaster relief, community projects, startups, and creative ventures. Crowdfunding's flexibility and reach make it a vital tool for individuals, businesses, and organizations seeking financial backing. The Financial Action Task Force (FATF), a global monitor on money laundering and terrorist financing, has produced a study on terrorist and extremist organizations' use of crowdfunding platforms.2 FATF is made up of members from 39 national governments and regional organizations and develops worldwide financial integrity standards.3 Crowdfunding, a legal way to raise cash, has been utilized by a variety of groups, including companies and NGOs. However, terrorists find it appealing due to the lack of transparency and scattered data on platforms. As global payment and financial technologies advance, the mechanisms that enable crowdfunding provide new issues for supervision, demanding enterprises, financial institutions, and law enforcement authorities to remain abreast of rapid developments.

The global crowdfunding market has experienced significant growth, with estimates suggesting it was valued at USD 17.2 billion in 2020 and is projected to reach USD 34.6 billion by 2026.4 This surge is evident in the over 6 million crowdfunding campaigns conducted worldwide in 2022.5 However, this growth has also attracted illicit activities, with threat actors exploiting donation-based crowdfunding and social media fundraising for terror financing.6 Such activities have been identified as methods of terrorism financing by the Financial Action Task Force (FATF). Despite its positive impact on innovation and entrepreneurship, the crowdfunding industry must address these vulnerabilities to mitigate the risk of exploitation for terrorist financing.7

1. Knowing Crowdfunding

(in context of Terror Funding)

Crowdfunding in India is expected to have reached $5 million by year-end 2023, with donation-based crowdfunding dominating the market. However, challenges include a lack of clear regulations for equity-based crowdfunding, which may not adequately address money laundering or KYC compliance. Transparency and oversight are also crucial to prevent misuse of funds. Technological weaknesses include robust cybersecurity measures and advanced fraud detection mechanisms. The government and regulators are working on strengthening regulations to ensure a safe and secure crowdfunding ecosystem. Crowdfunding platforms are implementing stricter verification procedures and leveraging technology for better risk management. Overall, India's crowdfunding scene presents exciting possibilities but requires a collaborative effort from stakeholders to address regulatory gaps, enhance transparency, and mitigate potential misuse.

Globally the disparate financial environments provide particular difficulties for initiatives aimed at terrorist finance. A distinct strategy is needed to handle the intricate, global financial flows of massive networks than to identify funding for lone-wolf attacks, which entails keeping an eye on smaller, more routine transactions. This discrepancy necessitates a multifaceted strategy that combines conventional financial surveillance techniques with intelligence-led initiatives able to spot any dangers concealed inside routine bank transactions. Crowdfunding encompasses various models tailored to different needs. Lending-based crowdfunding involves investing in projects to earn interest, akin to traditional loans. Equity crowdfunding offers shares or bonds in exchange for financial contributions. Reward-based crowdfunding provides non-monetary benefits to investors. Donation-based crowdfunding involves contributing without expecting anything in return. Physical donations involve in-person interactions, while digital donations occur entirely online, utilizing crowdfunding platforms, social media, or payment processors.8 These methods transcend geographical boundaries, enabling global participation. Technological advancements further streamline the process, allowing for quick, secure, and efficient transactions, revolutionizing the way fundraising is conducted worldwide. Crowdfunding models can be categorized based on the type of return they offer. Financial return models provide participants with financial benefits such as revenue, securities, or interest on loans. Non-financial return models, on the other hand, offer non-monetary benefits. For example, crowdfunding real estate ventures generate income for investors without providing financial returns. In this model, participants may receive goods or services as a reward or contribute funds without expecting anything in return.

In the diverse landscape of crowdfunding, several key actors play vital roles in its functioning. The 'Project Promoter' initiates a crowdfunding campaign, proposing projects that require funding and organizing the campaign on various digital platforms. 'Investors' in investment or lending-based models provide funds for the project in exchange for loans or securities. 'Donors' in donation-based models contribute funds without expecting anything in return. 'Backers' in reward-based crowdfunding pledge money to support a project, anticipating a reward if the campaign succeeds. 'Intermediary Organizations' facilitate connections between promoters and investors/donors through online platforms or social networks, which can include crowdfunding platforms, social networks, and associations with their own fundraising websites. Payment gateways and electronic processors help facilitate transactions within the crowdfunding ecosystem. These actors often overlap with other sectors, such as financial institutions, highlighting the interconnected nature of crowdfunding within the broader economy.9

Digital crowdfunding relies on efficient payment mechanisms to facilitate financial transactions. Platforms typically use third-party payment processors to manage transfers from donors to project promoters and to pay platform and transaction fees.10 These processors connect merchants to payment networks, enabling authorization and settlement of transactions. They provide the technology and infrastructure for various payment methods, including credit cards, debit cards, e-wallets, and bank transfers. Such mechanisms are crucial for the smooth operation and financial integrity of crowdfunding projects.11

Donation-based VA crowdfunding platforms enable fundraisers to donate virtual assets (VA) directly from their wallets to campaign wallets. Fundraisers can convert fiat currency to VA through VASPs and donate to the campaign, or transfer VA directly.12 After donations, fundraisers can convert VA back to fiat or hold it in wallets. Another approach involves creating a new VA token such as Bitcoin Token (BTCT), with donors purchasing it using established VA or tokens. FinTech enables crowdfunding by opening retail bank accounts for fundraising, often across borders, and centralizing funds in dedicated accounts. Crowdfunding's financial models will evolve alongside digital payment innovations, requiring ongoing adaptation.

Crowdfunding Vulnerabilities associated with Terrorism Financing and/or Violent Extremism

Crowdfunding, a tool designed to connect supporters with causes, has become susceptible to exploitation for Terrorism Financing (TF) or violent extremism. Donation-based crowdfunding, in particular, has been identified as vulnerable to misuse for such purposes. Terrorist financiers are drawn to crowdfunding due to its simplicity and global reach, allowing quick collection of funds from supporters worldwide.13 However, this method presents several vulnerabilities.

Firstly, the diverse range of organizations involved in crowdfunding can lead to accountability issues regarding Counter-Financing of Terrorism (CFT) measures, especially without a regulatory framework imposing due diligence standards. Additionally, information on clients and transactions can be fragmented, hindering transparency. The real purpose of fundraising campaigns may also be obscured, with funds potentially diverted for undisclosed uses. It can be challenging to verify the legitimacy of donors' funds and the ultimate recipient of the funds, further complicating oversight.

Despite these vulnerabilities, crowdfunding for TF has limitations. Crowdfunding's public nature can attract scrutiny, deterring some terrorist financiers. Also, listed terrorist entities may disguise their intent to avoid detection. Crowdfunding campaigns can fail due to a lack of support or platform deactivation for violating terms of service, highlighting some inherent limitations in using crowdfunding for TF.

Abuse of Crowdfunding

Smaller-scale or "lone-wolf" assaults are frequently self-financed and need significantly less capital. These assaults may be carried out by lone individuals or small groups on small-scale criminal activities, or personal savings who may be dependent on internet operated ‘Crowdfunding’. Crowdfunding, particularly through donation-based platforms and social media, has increasingly become a target for illicit activities by various threat actors. These operations have a very small financial footprint, and their transactions may be seamlessly integrated into other financial activity to avoid being noticed. Because these assaults are low-cost, they may be carried out without requiring a substantial amount of outside funds, avoiding the more closely watched large-scale financing routes. Operatives from larger extremist groups will also use these means to avoid vigilance and financial conformities, compared to the traditionally acquired (procured) funds.

The Financial Action Task Force (FATF) has identified online crowdfunding as a known method for terrorism financing (TF), highlighting its use in reports on Emerging Terrorist Financing Risks (2015) and Ethnically or Racially Motivated Terrorist Financing14 (2021). This exploitation underscores the need for enhanced vigilance and regulatory measures to combat terrorism financing effectively. As crowdfunding continues to evolve and expand globally, it is crucial to address these vulnerabilities to prevent further misuse by terrorist groups like ISIL, Al-Qaeda, and their affiliates.

The European Union's 2022 Terrorism Situation and Trend Report highlighted the shift of some violent extreme right-wing groups towards online funding methods, including crowdfunding.15 Case studies of crowdfunding supporting terrorism-related activities were also identified in a joint report by the Asia Pacific Group on Money Laundering (APG) and the Middle East and North Africa Financial Action Task Force (MENAFATF).16 In response to these emerging risks and the existing gaps in risk mitigation,17 the United Nations Security Council urged all Member States to assess and address potential risks associated with crowdfunding platforms.18The Delhi Declaration19 of the Council's Counter-Terrorism Committee in 2022 reiterated this call for action, emphasizing the need for robust measures to counter terrorism financing through online channels.

Abuse of Humanitarian, NGOs and Charities (from Crowdfunding perspective)

Terrorists and violent extremists often use crowdfunding sites to fund their unlawful operations, often disguised as charitable fundraising for humanitarian causes. These campaigns mimic legitimate fundraising strategies, such as setting public funding goals and creating promotional materials. However, funds collected are diverted to support terrorist operations, including travel or operational expenses. In high-risk environments, legitimate crowdfunding campaigns can expose non-profit organizations (NPOs) to extortion or other coercive tactics by terrorist groups.20 Authorities and crowdfunding platforms must remain vigilant to prevent the exploitation of humanitarian causes for illicit purposes.

Charities that function as fronts for terrorist groups, such as the Holy Land Foundation, may redirect funds for terrorist operations. The Holy Land Foundation was labeled a terrorist organization in 2001, and its assets were seized. In 2001, the Bush government labeled the Holy Land Foundation, America's biggest Islamic charity, as a terrorist group and confiscated its assets. A federal grand jury indicted the group and five former officials with aiding Hamas through West Bank charity committees in 2004, leading to their convictions in 2008.21The global terrorist funding watch dog FATF, in November 2023, reported terrorist organization’s funds solicitation activities in India. The observation with regards to Popular Front of India (PFI) was brought about when Indian officials reported that the violent extremist organisation that was under investigation collected funds through well-structured networks spanning the entire country. The organization used offline and online fundraising strategies, such as distributing QR codes and account details via which contributors were requested to transfer money, in addition to soliciting at mosques and public locations. There were more than 3,000 bank accounts and unofficial value transfer networks in use.22

Terrorists may also target nonprofit organizations, particularly in high-risk areas, by making them victims of extortion or skimming. Crowdfunding relies on donor goodwill, making humanitarian and non-profit causes attractive covers for illicit cash solicitation. This report highlights three common abuse scenarios: individuals without charity ties raise funds for a seemingly charitable cause but redirect the money to terrorism-related activities; legitimate charities launch campaigns but misuse funds for terrorism; and NPOs, even if crowdfunding for legitimate purposes, risk extortion or skimming in high-risk terrorist-controlled areas. Such exploitation underscores the need for robust regulatory frameworks and vigilance in the crowdfunding sector to prevent misuse and ensure donations reach intended beneficiaries.

Terror Crowdfunding via Social Media

Most of the top global crowdfunding sites accept both subscriptions and one-time donations. Users can also build their own platforms using open-source programming or internet apps. Users may interact with local or worldwide groups, magnify their voice, and build momentum for issues by using social media sites and messaging applications. Terrorists may utilize encrypted chat services provided by some sites to transmit money information and contribution instructions. Donors can give immediately using in-platform instant chat applications or gift contribution options. However, the Executive Directorate of the United Nations Counter-Terrorism Committee noticed fundraising loopholes on social media, such as "super chat" capabilities like YouTube's dollar bill symbol.23 During livestreams, viewers may give to YouTubers by clicking on a symbol and using a slider to send a certain dollar amount.

Abuse of Virtual Assets

In questionnaire responses, twelve out of forty FATF members stated that terrorist organizations such as al-Qaeda and ISIS24 are increasingly leveraging virtual assets in crowdfunding efforts, notably in the last three years.25 Tumblers and mixers provide anonymity by combining potentially recognizable virtual currencies, making it more difficult to track the origin and destination of cash. However, unlike major fiat currencies, transferring virtual assets to fiat currencies may not always be straightforward, and the volatility of virtual assets may present extra dangers.26

In recent years, there has been increasing attention on the misuse of Virtual Assets (VA) in terrorism financing, though assessing its true extent remains challenging compared to fiat currency. Twelve out of 40 countries surveyed noted terrorist financing crowdfunding activity using Virtual Assets, with detection rising since 2020.27 Terrorists and violent extremists may prefer Virtual assets for its perceived anonymity, especially when using services like tumblers and mixers to obscure fund origins. Others use VA to diversify funding sources. FATF Global Network updates between 2019-2023 indicate a rise in ISIL and Al-Qaeda fundraising via VA, including soliciting donations to VA wallet addresses through social media.28 Donors can send VA from personal wallets to addresses associated with terrorist financing campaigns.

Crowdfunding platforms increasingly allow donations using Virtual Assets (VA), sent directly to fundraisers' VA wallets. Terrorist groups create VA wallets, either hosted by VASPs/FIs or self-hosted with anonymous or pseudonymous identities.29 They solicit donations through websites, social media, forums, and messaging apps, urging support for their activities and sharing wallet addresses. They employ tactics like using new wallet addresses per transaction or voucher schemes to obscure transactions. Groups may specify VA or blockchain for donations, like using the TRON blockchain and USD Tether stablecoin.30 Interested donors transfer funds to shared wallet addresses. Terrorist groups may use mixers or non-compliant exchanges to obfuscate transactions, converting funds to fiat currency or using them directly for operations, including recruitment, propaganda, and attacks. However, limitations exist, such as challenges in converting VA to fiat currency, which may be necessary depending on fund use.31

The Hamas announced in April 2023 that they would no longer fundraise Bitcoin due to increased disruption of these types of donations.32 This decision indicates the challenges that terrorist groups face in using virtual assets (VA) like Bitcoin, especially regarding its volatility and potential disruptions. The FATF Global Network will likely continue monitoring the evolving use of VAs for terrorist financing, especially as new assets with enhanced privacy features emerge.

Abuse of Crowdfunding Portals

The proliferation of crowdfunding campaigns globally,33 exceeding 6 million in 202234, poses significant challenges in detecting illicit activities. The sheer volume and diversity of these campaigns make it challenging to identify illegal actions. Effective self-regulation is crucial to ensure compliance with legal requirements and platform terms of service. However, the rise of specialized platforms catering to individuals banned from mainstream platforms has complicated matters. Extremist individuals and groups exploit these platforms to raise funds for various activities, including those legally protected, such as funding legal fees or political campaigns. This underscores the need for heightened vigilance and robust regulatory frameworks to prevent misuse and maintain platform integrity.

Understanding the growing threat scenario and the actors participating in terrorist crowdsourcing is required. Because detection might be triggered by certain vocabulary or symbols, education and monitoring are critical. In the US the white nationalists launched three extremist-oriented crowdfunding portals in 2017: GoyFundMe, Hatreon, and RootBocks.35 OurFreedomFunding was founded in February 2021 to provide as a safe haven for deplatformed radicals' crowdfunding efforts. The Goyim Defense League (GDL) is a loose network of antisemites that target Jews both online and in person. Extremist crowdfunding efforts sometimes imply violence or violent intent. For example, the Nationalist Defense Force, a Weimerican security task force, held a GoyFundMe campaign to seek donations for equipment like as uniforms, shields, helmets, goggles, gas masks, and batons.36

Because of elements such as user profiles, platform names, and donor remarks, crowdfunding projects may be connected to terrorism or extremism. These may include terrorist-related rhetoric and symbols. To deceive funders, fundraisers may also give inaccurate information about the campaign, its aims, or recipients. legal crowdfunding campaigns may fail to discern between legal and illegitimate fronts benefiting terrorist organizations, and cash for criminal objectives may be mingled in with valid donations. According to a recent analysis by risk and compliance consultancy Kharon,37 Gaza Now, an online media platform, hailed recent Hamas strikes in Israel and the kidnapping, torture, and death of Israelis. Gaza Now has come under fire for its backing of Hamas and its terrorist leaders. Following the assaults, the gang initiated social media fundraising operations, asking money in multiple currencies. Mustafa Ayyash, the creator, has also shown his support on social media. Ayyash was detained in 2017 for Hamas ties, although he rejected the accusation and may still be living in Austria, where he manages the Gaza Now account on X.38

Abuse of Dedicated Crowdfunding Platforms or Websites

Dedicated crowdfunding platforms, designed specifically for fundraising, have become a focal point for various fundraising models, including subscription-based donations and one-time contributions. These platforms cater to a wide array of causes, ranging from community initiatives to niche interests. With over 1,400 crowdfunding platforms globally39, users can even create their own platforms using online tools or open-source code. However, some specialized platforms have emerged to support groups banned from mainstream sites, such as Hatreon, originally created for far-right users.40

Reports indicate an increase in the use of crowdfunding by ethnically or racially motivated violent extremist groups, funding activities like membership fees, political campaigns, and legal fees. These groups often exploit subscription-based crowdfunding models. Distinguishing between funding for violent extremism and legally protected support for hate-motivated causes can be challenging. While there are anecdotal mentions of crowdfunding on the dark web as a potential source for terrorism financing, limited official information is available.41

The ease and appeal of using dedicated crowdfunding platforms for terrorism financing depend on the campaign's nature and the likelihood of scrutiny. Terrorist actors may use multiple financing techniques to diversify their funding sources, including strategic use of crowdfunding. Consequently, regulatory bodies and crowdfunding platforms must remain vigilant to prevent the misuse of crowdfunding for violent extremist purposes.42

Utilization of Messaging Apps and Social Media Sites

Social media platforms and messaging apps have become pivotal in the realm of crowdfunding, offering unparalleled reach and accessibility to a global audience. Terrorist actors exploit these platforms adeptly, leveraging them to orchestrate crowdfunding campaigns and solicit funds for their illicit activities. URL sharing on social media networks facilitates the redirection of potential donors to crowdfunding platforms, where they can contribute to specific campaigns. Similarly, messaging apps are utilized to disseminate payment instructions, including encrypted messages to evade detection by authorities. Some platforms even offer self-destructing message features, further obscuring the trail of illicit transactions.43

Moreover, social media integrates fundraising campaigns directly into their platforms, allowing seamless donations without users having to leave the site. These integrated features, including in-app gift donation options and live stream "super chat" functionalities for video monitization, provide convenient avenues for funding terrorism while evading scrutiny.44 Sophisticated algorithms employed by social media platforms compound the issue by directing users towards extremist content based on their browsing histories and preferences. This targeted exposure can reinforce radical beliefs and ideologies, potentially leading at-risk individuals to contribute to terrorist financing efforts unknowingly.45

To counteract these challenges, collaborative efforts between platforms, authorities, and international organizations are imperative to detect and disrupt terrorist financing activities on social media and messaging apps. Vigilance, regulation, and technological innovations are crucial in safeguarding against the exploitation of these platforms for illicit purposes.46

2. FATF standards and crowdfunding activities

The regulatory landscape for crowdfunding, especially concerning Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT), remains complex and fragmented globally. While crowdfunding activities themselves are not directly covered by FATF standards, platforms offering crowdfunding services may be classified as Financial Institutions (FIs) depending on their operations. Donation-based crowdfunding platforms primarily serve as administrative platforms connecting donors with fundraisers and often partner with payment processors or Money or Value Transfer Services (MVTS) to facilitate donations.47 However, investment-based crowdfunding platforms that manage client funds themselves fall under AML/CFT standards.

Approximately 23% of countries do not regulate crowdfunding within their AML/CFT regimes, and 45% regulate it only for certain services like equity or securities fundraising. Only a few jurisdictions, such as France, Monaco, Portugal, and the United Kingdom, regulate both investment and donation-based crowdfunding under their AML/CFT frameworks.48 The diverse nature of crowdfunding models and the rapid evolution of the industry contribute to the differing regulatory approaches globally.

FATF emphasizes a risk-based approach, encouraging tailored risk mitigation measures that do not hinder legitimate activities. As crowdfunding continues to evolve as a legitimate financial activity, regulatory frameworks will need to adapt to ensure both innovation and compliance with AML/CFT standards.

Information Sharing with Law Enforcement

Most crowdfunding platform operators are not regulated by anti-money laundering or counter-terrorist financing regimes, which results in a lack of reporting duties and monitoring systems. Because of the lack of efficient information-sharing between public and private institutions, terrorist groups may continue to abuse these platforms. Greater cross-jurisdictional information exchange is required to better comprehend foreign groupings and terrorist organizations. Coordination and sharing, on the other hand, might take time and cause investigations to be delayed. Due to their reliance on payment processors to accomplish that job, online fundraising platforms may not demand identify verification, hampered law enforcement investigations.

Crowdfunding Red Flags - Exploitation Highlighted by FATF

The FATF report identifies several "red flags" that may indicate crowdfunding platform exploitation, such as the use of platforms with lax project review policies, the use of crowdfunding or financial technology platforms associated with individuals or groups linked to terrorism, reliance on donations made through mechanisms that obscure donor identity or source of funds, and encouragement of donations via anonymity-enhanced cryptocurrencies such as Monero and Bytecoin, Zcash.49

Crowdfunding firms should investigate campaigns that disguise their purpose, aims, and beneficiaries, assessing online language, average donations, and fundraising goals to see whether they are out of the ordinary or inconsistent with previous initiatives.

Banks and financial institutions should look into suspicious crowdfunding campaigns to see if the organizers have been investigated for terrorism or violent extremism crimes,50 if the campaign's receipts or amounts contain symbols used by known terrorist organizations, and if the campaign aims to support a specific group, such as terrorist relatives or foreign fighters, rather than the larger community.51

The Financial Action Task Force (FATF) recommends scrutinizing project promoters, especially if they are unfamiliar with the project or appear to be a third party. Additional due diligence is recommended for promoters seeking contributions exclusively in virtual currencies or closing crowdfunding pages quickly after achieving their fundraising goals. Deposits from crowdfunding sites followed by structured cash withdrawals should also be flagged. FATF also recommends examining donors and geographic risks associated with crowdfunding campaigns, particularly in countries with weak terrorism financing, poor implementation of FATF standards, poor oversight of the crowdfunding industry, or regions with terrorist organizations or comprehensive sanctions.52

Difficulties and Things to Take into Account When Fighting Crowdfunding for Terrorism Financing

By virtue of being a rapidly evolving industry operating across jurisdictions that have differing regulatory approaches, intermediary organisations that provide crowdfunding services face unique challenges in combatting the abuse of their platforms for terror funding and violent extremism purposes.

Fighting the exploitation of crowdfunding for terrorist financing presents a number of formidable obstacles for regulatory bodies and law enforcement agencies (TF). Crowdfunding activities pose significant risks to security and public safety. The large number of platforms and the anonymizing tools available on these platforms make it difficult to monitor illegal activities, especially for small-scale campaigns.53 Additionally, many nations have not methodically evaluated the terrorist financing (TF) risks associated with crowdfunding platforms or specific campaigns, leading to inadequate reporting and recording by authorities. Regulations regarding AML/CFT differ significantly between states, with crowdfunding methods relying on donations often subject to less regulation. This lag in regulations creates vulnerabilities that can be exploited. Limited resources and technical expertise also contribute to the lapse, with law enforcement and regulatory organizations often lacking the necessary staff and training to investigate allegations of misuse of crowdfunding to finance terrorism. Cross-border difficulties in vigilance and enforcement are also a concern. Crowdfunding's global reach makes it difficult to resolve jurisdictional conflicts and prevents different law enforcement agencies from working together. There is a disparity in legal principles dealing with cross-border investigations and knowledge sharing, hindering an integrated inquiry into data sharing and funding of terrorism.54

The difficulties brought on by crowdfunding sites' ignorance of violent extremism and terrorist financing (TF). Small teams that prioritize preventing fraud over TF detection are in charge of platform security on several platforms. While some staff members may not be aware of some terrorist groups' jargon and iconography, detecting TF and violent extremism demands a thorough grasp of the dynamic danger landscape.It is imperative that staff members receive continual training in order to guarantee that campaign evaluations are in-depth and not cursory. Public alerts on the need for better terms of service enforcement and internal monitoring systems on international platforms are still insufficient.55 Each firm is free to take action to delete questionable campaigns or donations in accordance with its own standards and risk tolerance. In order to overcome these obstacles, more knowledge, instruction, and preventative actions are required to identify and stop violent extremism and TF on crowdfunding sites. Lastly, a few delegations have brought attention to the deficiency of efficient channels for exchanging information between the public and commercial sectors engaged in crowdfunding. Governmental organizations might not always be permitted to divulge information to the private sector, even if they are aware that a certain user, crowdfunding campaign, or virtual wallet may be connected to terrorist financing.56 This implies that the dangers may not be completely understood by the private sector in order to reduce them.

The absence or restricted reporting systems in intermediate entities that facilitate crowdfunding based on donations, given that they are frequently exempt from AML/CFT regulations. Because they are not subject to regulations, these companies could not have the same advanced reporting or monitoring systems as well-established financial institutions.

In the absence of these monitoring tools, intermediate organizations can overlook any warning signs in crowdfunding initiatives pertaining to extreme violence or terrorism. Although several businesses have terms of service that specify how the platform should be used, these rules might differ and could not specifically address terrorism or the funding of terrorism. While some businesses give specific instances of unacceptable behavior, others just provide general principles that encourage threat actors to operate in a permissive atmosphere.

Intermediary organizations must put in place strong reporting and monitoring systems in addition to stricter and more detailed Terms of Service pertaining to terrorism and terrorist financing in order to solve these problems.57

This would assist in identifying and preventing the improper use of crowdfunding sites for nefarious ends.

1. Fragmented Ecosystem:

The dispersed structure of the crowdfunding payments ecosystem poses difficulties when it comes to delegating accountability for implementing due diligence protocols. Since they see themselves as transaction middlemen, some of the connected entities may not think it is their responsibility to watch for TF risks. Although they are not crowdfunding organizations, payment service providers help transfer money around and may find it difficult to disclose information because of legal restrictions. Effective monitoring and identification of TF threats is hampered by this lack of communication and collaboration. Clearing up the responsibilities and duties of various ecosystem players with regard to AML/CFT compliance and improving information exchange between crowdfunding platforms, payment processors, and regulators are necessary to address these issues.58

2.Challenges for Reporting Entities and Supervisors:

Difficulties reporting organizations encounter when trying to track down the source of money raised using social media or specialized platforms. It is difficult for reporting organizations to carry out due diligence because of the complexity and dispersion of crowdfunding activities. It's challenging to distinguish between reputable and dubious donations, particularly when cash flows fluctuate depending on the kind of campaign. The inability of payment references on social media sites to pinpoint recipient accounts makes it more difficult to track down questionable transactions. It is also challenging to identify suspicious activities because of the modest size and anonymity of donations.59 The swiftly changing crowdfunding industry presents regulatory obstacles, as supervisors find it difficult to keep up with the expanding quantity and magnitude of companies. To tackle these obstacles, it is imperative to implement refined due diligence procedures, augmented transparency in financial transactions, and regulatory structures that adjust to the dynamic terrain of crowdsourcing.

3.Difficulties for Prosecutors and Investigating Authorities:

Crowdfunding presents a variety of obstacles for FIUs and LEAs to investigate and prevent violent extremism and TF.60 Given that transactions involving crowdfunding might involve both intentional and inadvertent donors, proving the purpose underlying donations is a substantial problem. In order to deceive contributors, fundraisers may fabricate information, and certain platforms might not have robust identity verification procedures in place, permitting anonymity. Even for committed Trust and Safety teams, it might be challenging to identify fake efforts among genuine ones.61 Crowdfunding may be connected to terrorism but punished for other offenses like money laundering or fraud. As a result, terrorist financing indicators may be unreported. Terrorist financing instances are sometimes tried as economic crimes.62 Investigation and prosecution efforts are hampered by the time-consuming nature of tracking solicitations across platforms and the difficulty of obtaining information from social media providers.

4.Complexity of Operations:

The intricate terrain of crowdfunding activities poses a challenge to law enforcement and investigative agencies since it involves several entities, including financial institutions, payment processors, social media platforms, and virtual assets. Rapid money transfers and anonymity are made possible by the use of several digital payment methods, which makes it difficult to identify the persons involved.63 Furthermore, because crowdfunding platforms are international in nature, it is challenging for law enforcement to look into transactions with cross-border components.

The diversity of financial technology and the worldwide reach of crowdfunding platforms make transaction monitoring and control even more difficult. Investigations may be delayed by sluggish coordination and information exchange throughout jurisdictions. Furthermore, there is confusion regarding who is in charge of carrying out due diligence procedures and disclosing consumer information to authorities due to the differing levels of regulation throughout nations. Threat actors take advantage of these complications by spreading campaigns and ideas to a larger audience using internet platforms while staying under the radar. All things considered, the flow of money through crowdfunding is but one facet of a larger pattern of online behavior that presents formidable obstacles to regulation and inquiry.

Since of its complexity, crowdfunding presents a huge regulatory difficulty since it is difficult to distinguish between fundraising that is tied to terrorism and that which is not. Illegal money can readily pass for genuine contributions, preventing regulators from seeing it. Law enforcement and FIUs may find it difficult to fully comprehend the scope of criminal crowdfunding activity if financial institutions fail to identify customer behavior linked to crowdfunding.64 Tracking efforts are made more difficult when combining traditional and digital fundraising methods since terrorist financing schemes can take many different forms and are expensive to analyze. Large-scale solicitation networks are a common component of crowdfunding tactics, which increases the difficulty of regulatory and law enforcement activity.65

5.Lack of Data:

The absence of all-encompassing information about the improper use of crowdsourcing platforms for financing terrorism presents formidable obstacles for regulatory bodies and law enforcement organizations. Many nations don't have a good understanding of how much crowdfunding contributes to the funding of violent extremism and terrorism. Without this knowledge, nations find it difficult to identify their risks and put effective mitigation plans in place.66

The fragmented oversight of crowdfunding, wherein responsibilities are sometimes distributed among various agencies, some of whom may not have specialized AML/CFT tasks, further complicates the regulation of the industry. Coordination, collaboration, and information sharing—all essential components in the fight against terrorism financing—are hampered by this disjointed supervision.

Gaining additional insight into the extent of abuse might make it easier for platforms to recognize and address concerns related to terrorism funding. It may also make cross-border collaboration and information exchange easier, which is important considering the nature of many crowdfunding efforts.67 In order for regulatory organizations to properly manage terrorism financing through crowdfunding, they must close this data gap.

6.Anonymising Techniques:

The use of anonymizing techniques in crowdfunding poses serious problems for law enforcement and regulatory bodies.68 Tracking the movement of money becomes difficult and dispersed when transactions occur across several platforms. The use of encryption technology further obscures transaction details, making it more challenging for investigators to get vital data like transaction amounts and the names of the sender and receiver.69,Furthermore, access to crucial information for investigations may be delayed by the disparate policies on confidentiality and data sharing among platforms, particularly in the context of cross-border transactions.

Online fundraising sites sometimes do not require identity verification, which makes obtaining recipient information difficult and hinders law enforcement activities.70 Well-known terrorist and extremist groups take advantage of this anonymity when they use encrypted payment services to ask for money through social media, making it more difficult to track down and halt illegal funding. For crowdfunding operations to be transparent and accountable, platforms, regulators, and law enforcement must work together more closely to address these issues.

International crowdfunding platforms have implemented several responsible practices to prevent money laundering and terrorism financing. These include Know Your Customer (KYC) and Customer Due Diligence (CDD), which require users to provide government-issued identification and proof of address. They also need to identify the ultimate beneficiary of the funds and the source of funds for significant donations. Transaction monitoring and risk-based assessments are also crucial, using data analytics and algorithms to monitor transactions for unusual patterns.71 Risk-profiler campaigns are assessed based on factors such as the country of origin, project type, beneficiaries, and the amount of money involved.

Collaboration with payment processors is essential, as platforms integrate with payment processors with robust AML/CFT systems and use advanced fraud detection and prevention tools. Platforms are also required to file suspicious activity reports (SARs) with relevant financial intelligence units upon detecting suspicious transactions or activities.72 They adhere to international AML/CFT standards set by organizations like the Financial Action Task Force (FATF).

User education and transparency are also essential, with platforms providing red flags and guidelines for identifying suspicious activity. Clear terms of service prohibit illegal use of the platform. Platform security includes strong encryption, secure storage, and regular security audits. Vulnerability patching ensures that platforms are vigilant in updating their systems and software to address potential vulnerabilities.73

FATF’s report Crowdfunding for Terrorism Financing of October 2023,74 identifies four major ways in which crowdfunding platforms can be misused for terrorist goals, and in fact, terrorists and violent extremists utilize several strategies to generate cash and may combine different approaches. A terrorist, for example, may start a fundraising campaign on a specific crowdfunding site, promote it on social media, and ask for payment in virtual assets (VA).

3.Tackling Threat of Crowdfunding Abuse

Vulnerabilities in India's crowdfunding landscape

There are several potential vulnerabilities in India's crowdfunding landscape that could be exploited for terrorism financing. Crowdfunding platforms in India face several regulatory challenges, including weaker Anti-Money Laundering (AML) compliance, less stringent Know Your Customer (KYC) standards, lack of transparency, lack of due diligence on campaigns, limited oversight, technological vulnerabilities, and donor anonymity. These risks can make them attractive avenues for terrorist financing activities.

AML compliance is weaker compared to traditional financial institutions, making them attractive for disguising terrorist financing activities. KYC standards for user verification may not be as stringent as banks, allowing individuals with malicious intent to create fake accounts and funnel funds for terrorism. Lack of transparency and due diligence on campaigns also pose a risk. Limited oversight and technological vulnerabilities, such as payment processing systems and cybersecurity measures, make crowdfunding platforms vulnerable to hacking attempts and manipulation for terrorist purposes.

Indian agencies, including the Securities and Exchange Board of India (SEBI), are implementing stricter regulations and data analytics to mitigate risks associated with crowdfunding.75 To mitigate these risks, the Indian government and regulators are working on strengthening regulations, implementing stricter verification procedures, partnering with third-party KYC providers, and using data analytics to identify suspicious activity.

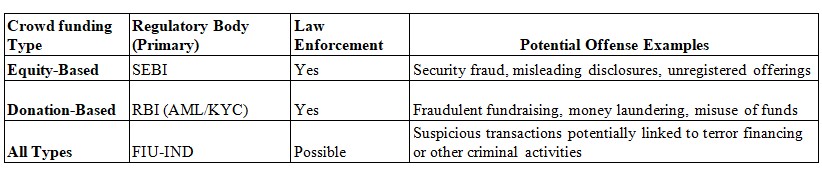

The government and regulators are also exploring blockchain technology and artificial intelligence to improve risk management and transaction monitoring on crowdfunding platforms. The Reserve Bank of India (RBI) oversees payment systems and digital transactions used by all crowdfunding platforms, ensuring adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) norms.76 The Financial Intelligence Unit - India (FIU-IND) analyzes financial transactions from all types of crowdfunding to identify potential money laundering or terror financing.77 Law enforcement agencies, including police and investigative bodies, investigate crimes like fraud, embezzlement, or terror financing linked to crowdfunding activities and gather evidence to file charges against individuals or entities involved in misuse of crowdfunding platforms.

Industry and Regulatory Best Practices

In India, several agencies oversee crowdfunding activities from a legal and law enforcement perspective. The Securities and Exchange Board of India (SEBI) is the primary regulator for equity-based crowdfunding, ensuring investor protection and preventing fraudulent activities. The Reserve Bank of India (RBI) regulates payment systems and digital transactions,78 ensuring payment gateways adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) norms. The Financial Intelligence Unit - India (FIU-IND) analyzes financial transactions and identifies suspicious activities linked to money laundering or terror financing. FIU-IND collaborates with crowdfunding platforms and other regulatory bodies to monitor activities and flag red flags.79 Law enforcement agencies investigate criminal activity on crowdfunding platforms, gather evidence, and take legal action against individuals or entities involved in the misuse of crowdfunding platforms. Some crowdfunding platforms may become members of Self-Regulatory Organizations (SROs) established specifically for the crowdfunding industry, setting additional compliance standards and ethical guidelines for their members. RBI has proposed setting-up a Self-Regulatory Organisation for fintechs.80 Indian regulatory authorities are focusing on best practices in establishing a robust crowdfunding framework. The Reserve Bank of India (RBI) on Thursday, 21st March 2024 finalised the Omnibus Framework for recognising Self-Regulatory Organisations (SRO) for its Regulated Entities.81 Self-Regulatory Organizations (SROs) are being encouraged to develop industry-specific compliance standards for anti-money laundering and combating terrorism financing. As the crowdfunding landscape matures, clearer regulations will be introduced to address terrorism financing risks. By implementing these best practices and collaborating with authorities, crowdfunding platforms can mitigate terrorism financing risks and create a safe environment for entrepreneurs and social causes in India.82

Globally some governments have started creating best practices for CFT and crowdfunding in addition to recognizing the typologies of crowdfunding misuse for violent extremism and TF.83

Based on their experience, certain best practices have been developed that can assist jurisdictions in effectively identifying, preventing, intercepting, and looking into TF through crowdfunding:

Increase knowledge of the characteristics and size of the domestic crowdfunding market. Crowdfunding has been included in national risk assessments (NRAs) in a number of nations.84 Crowdfunding is a growing industry that has been subject to various risks, including financing terrorism.While some countries conduct surveys to assess industry hazards, others remain unclear or unmeasured. A solid baseline of data can help understand the industry's development and emerging hazards.85,Factors that increase the risk of violent extremism and terrorism include the involvement of crowdfunding service providers in investigations, unregulated donation-based crowdfunding sites not under financial institutions' or supervisors' purview, the use of virtual assistants through unregulated channels, anonymity-enhancing cryptocurrencies, or privacy-enhancing technology, and the crowdfunding service provider's communication strategy, which emphasizes the need for clear terms of usage.

To mitigate risks, authorities should use an evidence-based strategy based on the risks specific to their jurisdiction when evaluating the adoption of regulatory measures for the crowdfunding industry. Many countries have already implemented regulations and designated supervisory bodies to ensure effective management of businesses operating within their borders. While other nations might not have laws specifically pertaining to crowdfunding just yet, they might nevertheless use the knowledge gained from other technologies—like virtual assistants—to figure out how to handle the changing financial payments environment. Countries should follow UN guidelines on performing human rights due diligence when deciding on suitable supervision and control systems.86

Reach out to the industry to raise awareness about TF. This will increase reporting organizations' ability to recognize and report suspicious transactions and enhance their adherence to AML/CFT requirements. Outreach would still be a useful strategy to raise private sector knowledge of illegal activities in areas where the industry is unregulated. This would assist authorities understand how crowdfunding service providers prevent platform exploitation.87 Depending on the scale of the industry and amount of activity, this involvement may take several forms, from casual discussions to more official supervisory inspections or audits.

Promote the expansion of AML/CFT initiatives in the business sector. This might be in the form of training, comprehending legal frameworks, identifying suspicious activities, or supporting initiatives spearheaded by the private sector to improve industry Trust and Safety procedures. A call to action for crowdfunding trust and safety teams to unite and exchange best practices in order to work toward a shared objective of purging dishonest actors and advancing trust and safety within our online global communities, for instance, was issued by Indiegogo and GoFundMe in the Crowdfunding Trust Alliance in 2021.88 In a similar vein, the Global Internet Forum to Counter Terrorism (GIFCT) is a non-profit organization that works to stop violent extremists and terrorists from using internet platforms by encouraging technological cooperation and information exchange. It provides its members with a range of resources and job opportunities.89 Last but not least, the global IT sector launched IT Against Terrorism as a way to combat terrorist use of the internet while upholding human rights.90 These projects might be pertinent for that goal even though they are not specifically related to CFT.

When thinking about the misuse of crowdfunding, have a comprehensive perspective. Because of the diversity of the crowdfunding ecosystem and the methods in which it functions, there are some vulnerabilities specific to it. Even while some countries may not regulate crowdfunding platforms, they frequently work with financial institutions or intermediaries who do. This implies that tracking the movement of money typically entails tracing it through a variety of financial companies. Social media and crowdfunding platforms provide greater context on customer behavior patterns, even if financial intermediaries could be better suited to analyze cash flows.91

Government officials, including supervisors and LEAs, should conduct a comprehensive investigation into potential abuse cases of crowdfunding by examining money movements, platform types, middlemen, client usage patterns, and the campaign itself. Collaborative channels should be established to improve information sharing about violent extremism and terrorist financing (TF). Government agencies should collaborate with businesses to combat the misuse of crowdfunding by these groups. Collaboration can involve working groups, unofficial discussion forums, or official public-private partnership projects. Supervisory agencies can assist crowdfunding providers in recognizing new TF trends and warning signs in the context of Public Private Partnerships (PPPs), enabling private sector organizations to identify questionable activity and take appropriate action within legal authorities.92

Precise procedures for reporting and identifying instances of crowdfunding abuse should be in place. Crowdfunding sites and their middlemen, who also benefit from their services, must take reasonable precautions to ensure their platform is not abused for illicit purposes, such as TF.To protect contributors and recipients' anonymity, appropriate identification and verification procedures should be implemented. Additionally, crowdfunding sites should consider including a clause in their Terms of Service detailing forbidden acts and the repercussions of such activities. It is crucial for crowdfunding sites to notify authorities of any suspicions of terrorist financing, in compliance with local legal norms.

Indian authorities are implementing best practices to mitigate terrorism financing risks in crowdfunding. These include implementing Know Your Customer (KYC) and Customer Due Diligence (CDD) procedures to verify the identity and legitimacy of donors and campaign creators, conducting ongoing CDD to monitor user activity, and may report suspicious activity to the Financial Intelligence Unit - India (FIU-IND).93

Furthermore, they are implementing thorough vetting procedures for crowdfunding campaigns, reviewing campaign descriptions, verifying the legitimacy of the cause, and assessing the risk of misuse of funds. They are also partnering with third-party background screening services to verify information provided by campaign organizers.

Transparency and public awareness are also being promoted, with clear guidelines for acceptable fund uses and mechanisms for donors to report suspicious activity. Users are also educated about the risks of terrorism financing and how to identify red flags in crowdfunding campaigns.

Technological solutions are being explored, such as data analytics tools and blockchain technology for secure and transparent transaction tracking. Open communication channels with regulatory bodies and law enforcement agencies are also maintained to share information about suspicious activity and collaborate on investigations to prevent misuse of crowdfunding platforms for terrorism financing.

Fintech for Crowdfunding

Fintech can be a powerful tool in enhancing crowdfunding activities in India. It can streamline transactions, provide secure payment processing systems, and integrate with mobile wallets and UPI for convenience. Artificial intelligence and machine learning can analyze user data for real-time fraud detection and risk assessment.94 Blockchain technology can improve transparency and traceability of funds, making it harder to misuse platforms for illicit activities.95 Fintech solutions can automate KYC processes, verify user identities, and integrate with credit bureaus for robust risk assessments.96 They can also provide campaign management and fundraising tools, allowing campaign creators to target the right audience and optimize their fundraising strategies.

It's important to clarify that Fintech (financial technology) doesn't inherently counter crowdfunding. Fintech can actually be a powerful tool to facilitate and enhance crowdfunding activities. Fintech be leveraged in the Indian crowdfunding landscape.97

Fintech solutions are revolutionizing the crowdfunding industry by offering secure, efficient payment processing systems, enhancing risk management, and improving due diligence. These solutions integrate with mobile wallets and UPI, making crowdfunding campaigns more accessible to a wider range of users in India. AI and ML can analyze user data for real-time fraud detection, while blockchain technology enhances transparency and traceability of funds. Fintech also automates KYC processes, verifies user identities, and streamlines customer onboarding. It also provides efficient campaign management tools, enabling better tracking of progress and communication with donors or investors. Fintech can also be used for alternative funding options, Peer-to-Peer lending (P2P) potentially reducing reliance on crowdfunding. However, regulators must focus on regulations to prevent vulnerabilities exploited for illegal activities like money laundering or terror financing. Overall, fintech complements crowdfunding by enhancing security, efficiency, and accessibility, promoting responsible financial inclusion and growth, and making them more accessible and efficient. Fintech advancements necessitate responsible implementation by regulators to prevent vulnerabilities that could be exploited for illegal activities like money laundering or terror financing.98

1. Recommendations to the Governments

A risk-based strategy that encourages nations to consistently monitor the ways in which terrorists and criminals get, utilize, and transfer money is at the core of the FATF's approach to combating TF.

As per the guidelines outlined in FATF Recommendation 1, responsible authorities have to make sure they recognize, evaluate, and comprehend the ML/TF risks associated with their nation and take steps to effectively mitigate such risks.99 This involves making certain that any emerging TF risks—like those presented by crowdfunding activity—are identified as soon as they materialize. Data that enables nations to make well-informed, fact-based choices is crucial.100

In their own jurisdiction, countries should evaluate the nature, scope, and dangers associated with all forms and methods of crowdfunding, including businesses, people, and other organizations that could offer services that are comparable to or complementary to those offered by crowdfunding. Countries should also take into account the possibility of changes in this sector over time. Given the cross-border nature of crowdfunding campaigns and the related money transfers, countries should also be more cognizant of the risk assessments of this industry on a worldwide scale. Specifically, nations must to acknowledge that their territory can function as a conduit for money transfers even in the absence of notable acts of terrorism within its borders.

Countries have to fully apply the FATF Standards pertaining to VA, NPOs, and MVTS, considering the connections between crowdfunding activity and other financial and non-financial sectors and payment systems.102

Acknowledging the value of exchanging information between the public and private sectors, nations should maintain outreach and awareness campaigns to make sure crowdfunding providers and facilitators are informed about risks, patterns, and warning signs related to terrorism financing in their jurisdiction. In order to develop improved detection efforts that are suitably tailored to address hazards while reducing unintended outcomes, public-private cooperation may be very effective.

Nations should also take efforts to let business know about the resources at their disposal for reporting TF-related suspicious transactions. Relevant service providers should make sure their employees have enough training to identify any occurrences of TF in fundraising efforts and take appropriate action. Additionally, they should make sure that their websites contain tools for consumers to report information that needs to be reviewed by the business or suspected fraudulent fundraisers.

When creating and assessing the effects of measures aimed at lowering TF risk connected to crowdfunding, countries should establish a multi-stakeholder approach that involves appropriate national agencies, the business sector, civil society, and academics to ensure human rights due diligence.103 In addition, it is recommended that nations contemplate utilizing collaborations across three domains: public-private, public-public,104 and with foreign governments and multilateral organizations.105 This will guarantee a thorough comprehension of the complex nature of risks and suitable mitigation through the implementation of best practices delineated in this document.

Risk Indicators

Risk Markers for Terrorism Financing and Violent Extremism via Crowdfunding

• Across the FATF Global Network, there are wide variations in the risk of using crowdfunding for terrorist activities. Certain countries have reported no danger or incidents involving crowdfunding, whilst others have found numerous instances of terrorist organizations utilizing the platform and have classified crowdfunding as a "high" overall risk in their national risk assessment.106

• Similarly, donation-based crowdfunding seems to be the most vulnerable sort of crowdsourcing, even while not all forms of crowdfunding are equally susceptible to being utilized for violent extremism or terrorism.107,The majority of the indications in this chapter are related to using donation-based crowdfunding to identify violent extremism and/or terrorist financing.

• The list of signs that follows is not exhaustive. While a single risk signal by itself may not always be a direct sign of terrorist funding, it can, when necessary, spur more observation and investigation. If many indicators regarding a customer or transaction are present, more investigation is necessary. It is improper to use any of these markers to discriminate against a certain nation, religion, ethnic group, or kind of institution.

The following indicators are arranged based on the many functions that are present in the ecosystem of both official and informal crowdfunding. Reporting agencies, operational authorities, crowdfunding platforms, and other private sector parties wishing to establish internal monitoring and reporting systems can all benefit from these metrics.

Indicators Related to the Intermediary Organisation

Intermediate organizations can be identified by operational authorities and reporting institutions for potential terrorist financing or violent extremist activity. These organizations may fund projects via crowdfunding platforms with lax review policies and terms of service that do not explicitly forbid content that encourages or incites violent extremism or terrorism.108 Contributions may be routed in an unduly complicated manner or made using methods that conceal the donor's identity or the source of the cash. The intermediary organization or crowdfunding platform may host or facilitate other projects linked to radicalism or violent extremism. Platforms that offer services related to financing terrorism motivated by ethnicity or race may also be used. Platforms that permit or demand payments through unregulated financial institutions may also be involved. The organization may promote contribution strategies using privacy coins, upgraded cryptocurrency models with anonymity features.109

Metrics Related to the Crowdfunding Project

Crowdfunding campaigns, ranging from informal social media to specialist platforms, can raise suspicions of financing terrorism. Fundraising companies, organizations, and authorities should be aware of red flags such as insufficient details on the campaign's objectives, hostile language, small projects collecting money from offline individuals, unusual or inconsistent average contributions or fundraising goals, and methods of donation that obfuscate the source of funds or provide unique donation links. These indicators can help identify potential breaches and ensure the safety of individuals involved in crowdfunding campaigns. It is crucial for fundraising companies, organizations, and authorities to be vigilant and aware of these potential red flags to prevent terrorism financing.110

Recent data from a 2023 TRM investigation revealed a trend: throughout 2022, terrorist organizations and related fundraising efforts significantly increased their usage of the decentralized,111 blockchain-based TRON operating system, with some utilizing it solely. The vast majority of those performers took donations in Tether (USDT), a stablecoin. Tether usage increased 240% year over year among the terror funding groups that TRM Labs examined in 2022, compared to a paltry 78% growth in bitcoin use. TRM (2023), Report on the Illicit Crypto Ecosystem.112

The crowdfunding campaign is allegedly linked to violent extremist or known terrorist organizations, with social media platforms and websites endorsing these organizations. The campaign also organizes events to raise money for social causes on days with special meaning for these groups. It also raises a support fund for criminal defense costs for those with known offenses connected to terrorism. The campaign is operated by unregistered individuals or groups and purports to be raising money for humanitarian reasons, such as children living in conflict areas. However, individuals involved in the campaign have been the focus of inquiries and legal actions concerning offenses associated with violent extremism or terrorism. The campaign's receipts and sums are often used by violent extremist and terrorist organizations. The initiative appears to be fake, impersonating or having a name similar to a well-known campaign or group. Instead of benefiting a larger community, the campaign focuses on supporting specific groups, such as sympathizers or terrorist families, rather than the local community as a whole.113

Metrics Concerning the Project Sponsor

Know-your-customer procedures are necessary to comprehend the financial behaviors of your clients and to identify any deviations that could point to illegal activities. Authorities and the private sector should take into account data from a range of sources when creating or evaluating targeted risk indicators. These sources include, but are not limited to, information from law enforcement agencies, analysis of internal transaction data, review of Internet Protocol data, and analysis of suspicious data specifically related to potential terrorist financing or violent extremism events.114

Customer due diligence begins before a commercial connection is established and is carried out by keeping an eye out for any changes in the customer's behavior or financial profile, including shifts in the source of funding and spending patterns.

This is especially relevant to investigators who would have access or the ability to share such information with domestic intelligence services.115

To establish suspicion of terrorist funding and violent extremism-related behavior via crowdfunding, it is essential to know certain details about a client, such as their documented financial transaction history. Some signs that might point to questionable terrorist funding and/or violent extremism-related behavior include the project promoter not seeming familiar with the project or appearing to be a third party unconnected to the fundraiser's goal.

Quick structured cash withdrawals occur after deposits of money made through crowdfunding sites, and deposits are accepted or combined from several accounts, with payments sent immediately to crowdfunding campaigns.116 Individual accounts receive checks and deposits from foreign businesses, especially those operating in high-risk areas, and anonymous and unconnected parties. The crowdfunding campaign promoter only seeks payment in the form of virtual assets, specifically coins that enhance anonymity.

The project promoter may also use bank accounts or other financial intermediaries that are not physically connected to the project being publicized. The project promoter may raise money or gather donations on behalf of a third party, but they are not the project's point of contact.117

Funds may be transferred in a manner that deviates from the project's or fundraising campaign's intended purpose, such as cash withdrawals, transfers to unaffiliated third parties, and misalignment between the intended use of funds and their original purpose.

When a business or person uses social media and crowdfunding platforms to raise money, the project's online appearance vanishes as well. Donations are gathered through individual accounts and transmitted overseas. Transfers via intermediaries that conceal the source of funds or make tracking more challenging can also be problematic.118

Donor-Related Indicators

Witting or unaware funders may be involved in the financing of terrorism, particularly through donation crowdsourcing. Regarding the former, there exists a variety of data that may point to questionable activities associated with financing terrorism or violent extremism, a large portion of which may be obtained through open-source research. It is crucial to take into account the contributors' actions in this situation as well as any possible affiliations (should an inquiry be conducted).

On occasion, crowdfunding initiatives that accept donations could draw a contributor who has ties to illegal activity. This does not establish or suggest that the campaign's goal is to collect funds for violent extremism or terrorism on its own.

On the other hand, details on one or more donors exhibiting questionable behavior can prompt more research into a crowdsourcing project. When evaluating possible suspicion related to financing of terrorism or violent extremism, the following factors should be taken into account.

Crowdfunding projects often involve excessive security procedures and attempts to conceal donors' identities or donation sources. Participants known to be extremists receive monetary contributions from outside sources, such as credit cards, which are not derived from commercial transactions or social or economic dependence.

The value of gifts and donor profiles are inconsistent, and many businesses are conducted with purportedly humanitarian groups or nonprofit limited liability firms associated with radicalization, extremist, or violence-promoting propaganda.119The campaign has attracted donations from well-known violent extremist blogs and websites that support terrorism and extreme violence. Supporters may appear fake, with multiple accounts or IP addresses used in fundraising projects. Donors may have ties to groups supporting violent extremism or terrorist organizations.120 The source of funds is unclear, and contributors often choose methods that offer more secrecy, such as cash, virtual assets, or prepaid cards.

Indicators Based on Geographic Risks

Some geographical areas may be more vulnerable to the financing of violent extremism or terrorism and may be utilized as a country of origin, transit, or destination for the cash. Geographic hazards should always be taken into account, such as when a transaction's originator or fund beneficiary is connected to an area or country that has a high level of risk. Geographic risk can also be related to a person's nationality, location of residence, or place of employment.121

Geographic risk indicators include:

The crowdfunding campaign is benefiting organizations with ties to war zones or neighboring regions, receiving large donations. However, the campaign is being conducted in countries with weak legislation against crowdfunding and terrorism financing, with inadequate supervision and application of FATF Standards. The campaign is also being conducted in areas where terrorist groups are active, making the countries from which the money is raised highly vulnerable to violent extremism or terrorist financing. The money is being sent to these countries, and instructions for payment or donation are sent from IP addresses located in these regions. This raises concerns about the potential risks associated with crowdfunding and terrorism financing.

2.Caution to the Public

The Public has been approached to give money to charities, causes, and people in need through crowdfunding sites, social media platforms, and other online fundraising platforms. One approach to raise money online is through person-to-person crowdfunding. Crowdfunding campaigns may be created by users on websites such as GoFundMe, Kickstarter, and Indiegogo. The organizers receive the payments promptly, and they are simple to set up.

Donate money to no crowdfunding scams.

Before you donate, it's crucial to perform your own investigation since it may not always be able to determine later on if a crowdfunding campaign was legitimate and whether the funds truly reached the intended recipient. Here are some pointers:

Discover the person(s) behind the crowdsourcing request. Make offline contact with your buddy if they shared, liked, or posted the request on social media. Inquire about their knowledge about the role. Do they know who or what group will receive the funds? If not, try locating the campaign organizer's name and researching them online. The organizer's identity need to be disclosed by the crowdsourcing website. Be wary if you are unable to locate them online or if the information you do discover contradicts their claims on the campaign website.

Examine the images used on the crowdfunding campaign website using a reverse image search. To find out whether the campaign photos are linked to other names or if the details don't align with the crowdfunding campaign's message, use your web browser's reverse image search feature. Additionally, perform a reverse image search on the social media profile photo of the campaign organizer. Scammers frequently take advantage of stolen images and edit other people's narratives. There are certainly alternative ways you can aid if you discover something odd. Contributions to crowdfunding projects run by individuals you know are the safest method to make a donation.

Campaigns using crowdsourcing to finance an idea or business venture

A businessperson wishing to raise money for an idea or project might launch a crowdsourcing campaign. Even while they might just be asking for modest donations of Rs. 1000, Rs. 5000, Rs. 10000, they can soon mount up to thousands of dollars in financing.

In other situations, the objective is to persuade individual investors to contribute substantial sums of money, sometimes in return for a benefit once the project is finished, such as receiving a prototype of the new device or some other incentive. However, a dishonest businessperson might make up information regarding the product or project and when it will be finished. They may also exaggerate the benefits that funders would receive when the project is completed.

If someone approaches you to contribute to a crowdsourcing effort in order to finance an innovation or commercial venture, Conduct your own research. Look up the campaign organizer online and find out who they are. The platform for crowdsourcing ought to identify that for you. Look for the names of the organizer and the project along with the terms "scam," "review," and "complaint." Look into what you can learn. Interrogate the campaign organizer incessantly. Have they successfully introduced any additional products? Have they used crowdsourcing to finance those projects? Utilize internet resources to confirm the details. Find out what happens to your funds in the event that the project is unsuccessful. The project's completion and the success of the crowdsourcing effort are not guaranteed. Then, would you receive a refund? What dangers are present?122

Verify the state of manufacturing. A 3D image of the product does not indicate that it is complete. Make sure you understand the current development state and request a production timetable. Because donors can confuse 3D photographs of the product for a finished product, several crowdfunding platforms prohibit fundraisers from posting 3D photos of the goods on their websites. Find out from the campaign organizer whether a prototype exists and whether you may view it. Recognize the campaign's objective. You are not purchasing the product when you donate to an idea or business through a crowdsourcing website. You're only contributing to its production costs. Make it apparent why the money is being raised and whether you stand to gain anything from it.

Crowdfunding initiatives for health care. Don't assume that just because a medical therapy is being funded via a crowdsourcing effort, it has been tried and proven effective. Crowdfunding is used to promote certain dubious and ineffective medical therapies. Contributors to crowdfunding initiatives aimed at developing medical treatments run the risk of losing the money they contribute. It's likely that the medical intervention will be ineffective. Additionally, people may be misled about the safety of these experimental treatments and attempting them might result in significant injury.

Using Social Media to Donate. You have undoubtedly seen posts on social media from individuals requesting money if you use them. Keep an eye on who is making the requests and receiving the funds. Never assume that simply because a friend posted anything on social media, it's authentic or that hyperlinks point to the correct location. Potential for spread of terror through social media higher than ever.123