A lot has been spoken or written about Atmanirbhar Bharat since Prime Minister spoke about reducing dependence on various goods and services and self-sustainability. Opinions on this issue are diverse and wide. Opinions may not give a clear picture of governments policies as well as larger trends. Perhaps trade data can help us in understanding India’s position in manufacturing and imports from China.

What India import from China?

China is known for its electronics export. However, cheap Chinese imports are occupying various other industries in India. Apart from core imports such as chemicals, metals, electrical, electronics and mechanical goods India imported goods worth ₹1,04,567 crore from China in the financial year 2018-19. Out of total import from China, 20 per cent include vegetables, processed food, rubber, plastic, leather, wood, paper, textile, footwear, headgear, cement, ceramics, glass, transport goods including railway, vehicles, clocks, musical instruments, furniture, toys, etc. India’s fertilizer import from China reached ₹14,412 crore, which is 31 per cent of total fertilizer import.

In the year 2018-19 India imported toys worth ₹3,162 crores from China. Furniture import from China stood at ₹6,931 crores. Import of optics, cameras, clocks, musical instruments reached ₹11,705 crores. At ₹23148 crores, Chinese import of textile and fashion goods stood at 40 per cent of total import in the same category. All these items can be manufactured by local MSMEs or can be sourced from other countries. People through their buying power can change this import trend in consumer goods such as clothes, toys, furniture.

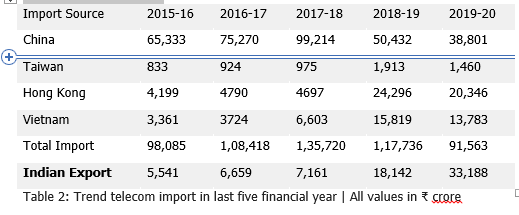

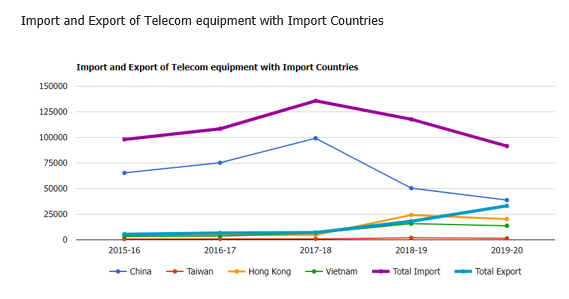

Changing Telecom Import

In the financial year 2017-18, India imported ₹99,214 crores worth of telecom equipment including mobile phones. In 2018-19 telecom import reduced by 49 per cent to ₹50432 crores. In the year 2019-20, import of the same commodity from China further decreased to ₹38801 crores.

In 2017-18, import of telecom equipment from China stood at 73% of total import in the same commodity. In 2018-19, that percentage reduced to 42%. The total value of telecom import in the year 2018-19 stood at ₹1,17,736 crores. India’s import dependence on China for mobile and telecom has been in steady decline since 3 financial years along with the growing value of export from India. Telecom export has increased by 153 per cent and 82 per cent in consecutive financial years.

There is also diversification with imports from Vietnam, Taiwan. Indian import from Taiwan has increased from ₹957 crores to ₹1913 crores. Imports from Vietnam has also increased from ₹6,603 crores to ₹15,819 crores. This change is driven by Government initiatives and corporations that are leaving China. Government is attracting investment in India and Global companies are reducing their dependence on China as a sole manufacturing location.

Last year, worlds largest mobile manufacturer Samsung closed its last mobile manufacturing plant in China. Samsung’s market share of mobile devices declined to one per cent in China in 2019. In 2013 Samsung enjoyed thirteen per cent market share in China. As Chinese mobile manufacturers grew, sales of non-Chinese mobile manufacturers like Samsung declined heavily.

The trend is not different for other non-Chinese mobile makers such as Apple and Sony. This has been an echoing trend in China. As local alternatives emerge with state support, doing business in China becomes difficult. It happened with Google and Amazon as well. State support gives Chinese companies a unique competitive advantage which peer companies lack. As a result, foreign companies are forced to close their operations in China.

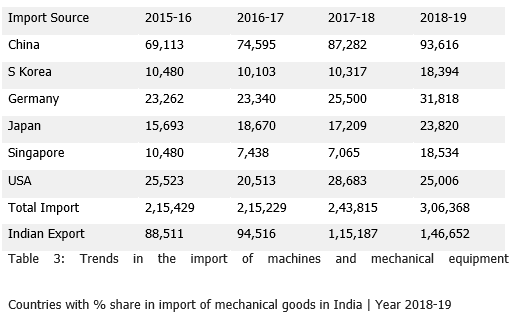

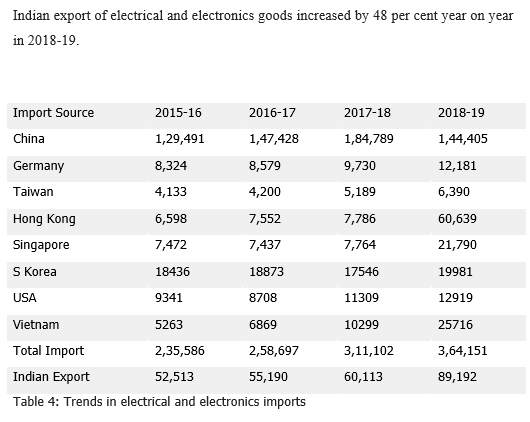

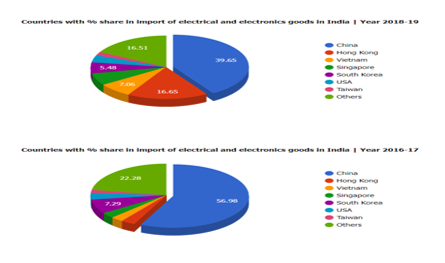

Trends in import of mechanical equipment, electrical and electronics products

India’s import of machines and mechanical equipment is growing along with the value of export. In 2018-19, year on year value of import increased by 25 per cent while export from India increased by 27 per cent. In the year 2017-18, Indian export grew by 21 per cent year on year.

China’s share in total import of mechanical goods has declined from 35.79 per cent in 2017-18 to 30.68 per cent in 2018-19. Although thirty per cent share of China in the import of mechanical equipment needs to be further diversified and reduced. Import from Singapore, South Korea has increased. Though, a drastic surge in the import of mechanical and electrical goods in the last two financial years from Singapore and Hong Kong raises concerns about the rerouting of Chinese goods.

Import of electrical and electronics goods from Hong Kong has increased from around 3 per cent to around 17 per cent for the last two financial years. The combined value of electrical import from China and Hong Kong stood at ₹2,05,044 crores. Collective import from Hong Kong and China again reaches to 56.30 per cent. The sudden increase in import from Hong Kong is particularly alarming. With one country two systems, China can easily use Hong Kong to avoid ‘Made in China’ tag on Chinese goods. India’s free trade agreements with East Asian nations can as well be a reason for worry due to possibility of rerouting and dumping of Chinese goods in India.

Way Ahead

Reducing dependence on Chinese import needs a collaborative approach of government, industry and people.

• Government establishments such as Indian Railways should look for Made in India alternatives as the first option for future contracts. In 2019-20, India imported ₹1,445 crores worth of railway equipment from China.

• The government should look into rerouting of cheap Chinese goods via other countries.

• India and like-minded countries can partner to manufacture electrical and mechanical good to reduce dependence on Chinese goods.

• Government through diplomatic channels can help the private sector in diversifying sourcing of materials and components.

• Businesses need to reduce sourcing of chemicals and materials from China.

• Indian MSMEs should be promoted to fulfil the demand for consumer durable and sourcing.

• For all online retailers specifying the country of origin should be mandatory for people to make informed decisions.

• People, with their buying power, can influence stores and business to opt for non-Chinese goods.

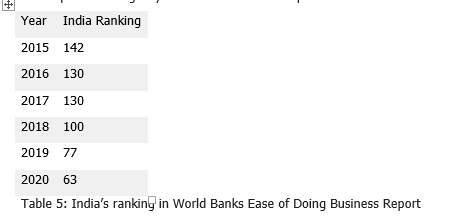

Ease of doing business

India has made positive progress in the ease of doing business ranking. The government policies are showing results. In 2015, India ranked at 142nd position in ease of doing business. In 2020, India has climbed up to 63rd position in the global ranking. However, it is not enough considering India’s growth requirements and aspirations. Land acquisition and delay in dispute resolution is a challenge that India needs to overcome to reach Very Easy status in ease of doing business. Delay is a key weak spot in the legal system for commercial dispute resolution.

Don’t hinder the innovation

Delay in the regulation of modern technology is another concern that hinders development and manufacturing. India introduced rules for the use of UAVs in December 2018. Many other nations introduced such regulations 4-5 years before. Ambiguity and regulatory delays act as deterrence in the development of new innovative products. The cost of being laggard in technology is very high. Lack of clarity and delays also create roadblocks in the development of local technology brands. India doesn’t have big tech manufacturing brands. Even so, Indian MSMEs manufacture and export various subsystems across the world for leading tech brands. That speaks about the capability of Indian manufactures.

Manufacturing scalability, MSME ecosystem and environment for innovation without bureaucratic roadblocks are all that is needed for the success of the indigenous brands and advanced manufacturing in India. India has the first two components. Talented human resource is available. The only question that remains is whether we want to be early adopters or we want to follow others in the adoption of new technology and lose first-mover advantage.

Environment for innovation without bureaucratic roadblocks is one of the reasons for the Indian Space Research Organisation’s success rate. Red tape has obstructed technology development and industry for long. The government establishments should be open and approachable for local developers and innovators. Afterall people tinkering with ideas, technology, and systems is fundamental for innovation.

India’s partnership with Australia, Japan, South Korea, Taiwan, USA can contribute in reducing India’s dependence on China for resources. Fast-track investment in manufacturing from the above countries is a win-win situation. Furthermore, India should attract original chip makers like Taiwan Semiconductor Manufacturing Company (TSMC) to set up manufacturing in India.

Previously boycott of ‘Made in China’ goods was short-lived and temporary. If the current trend continues for a longer duration (2 years), it will contribute to a radical shift in manufacturing as well as diversified sourcing.

According to China, modern warfare is economic, technological and psychological (Qiao Liang, 2007). As a result, it’s important that economic relationships should run parallel to strategic partnerships.

Alternatives to Chinese goods are emerging rapidly, and people should demand options. The perception that China is the only source for commodities does not fit into the reality of trade numbers. There is no denial that PRC has established itself as a significant manufacturer for everything. There is a dangerous side to China’s state-driven economic growth. State-driven growth seldom leads to the creation of overcapacity. As long as goods are cheap overcapacity serves well. When demand scenario change, overcapacity turn into a liability quickly. Overcapacity of Chinese manufacturing worries Chinese policymakers as a phase of state-driven growth is over for China, and countries like Vietnam, India is emerging. Economic activity can not be a one-way street. Cooperation is possible when it delivers prosperity for the people of the two countries. Dumping cheap goods while creating barriers for others does not sound like cooperation.

The government, businesses and people must stick to ‘Atmanirbhar Bharat’ goal as a long term national strategy to achieve results.